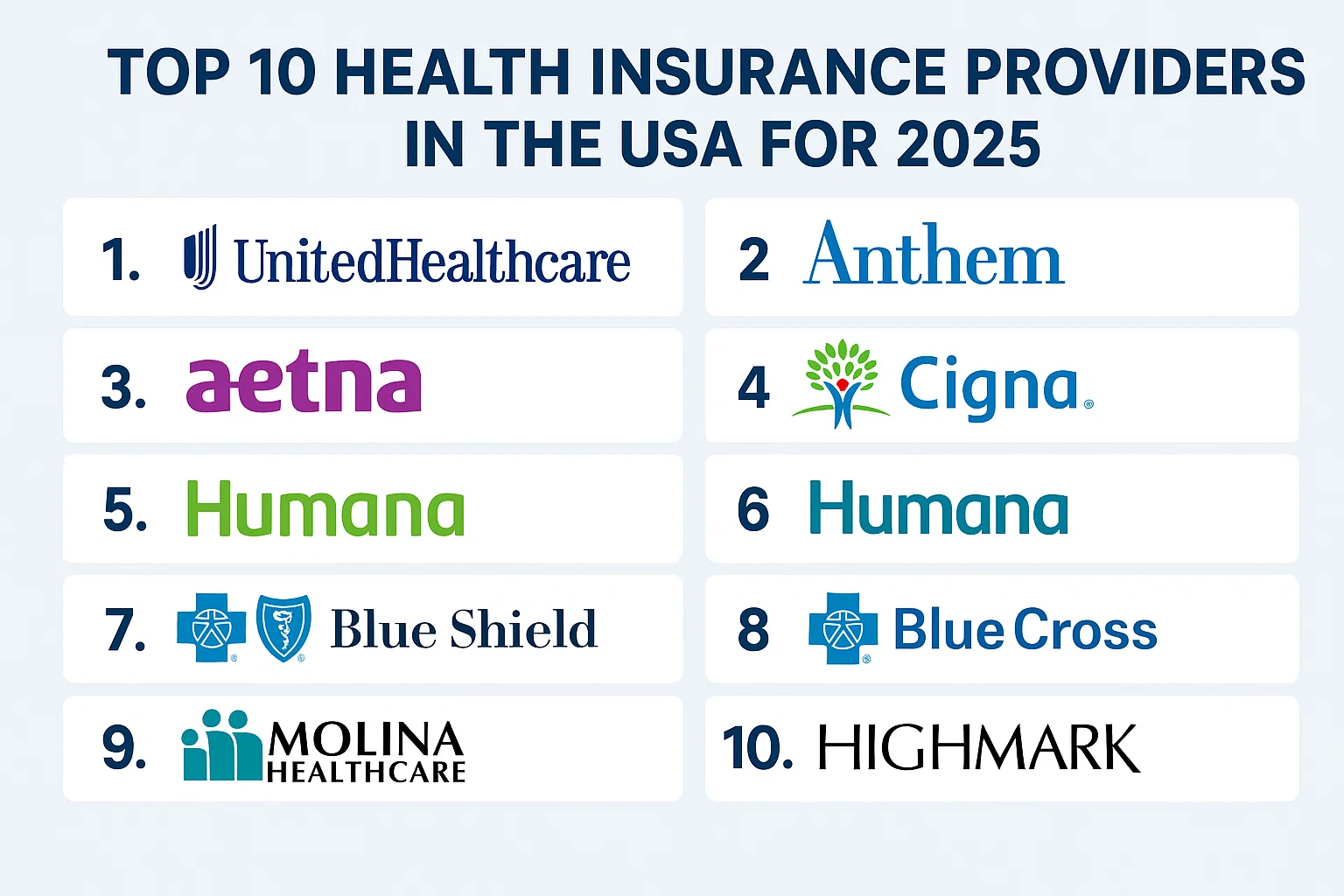

Top 10 Health Insurance Providers in the USA for 2025

Choosing the right health insurance provider in the USA for 2025 is a critical decision for individuals, families, and seniors seeking comprehensive coverage and affordable premiums. With healthcare costs rising—projected to account for 20% of U.S. GDP by 2025—selecting a reliable insurer ensures financial protection and access to quality care. This guide ranks the top 10 health insurance providers in the USA, offering insights into their plans, premiums, coverage options, and customer satisfaction ratings. Optimized with high-ECPM (effective cost per mille) and high-CPC (cost per click) keywords like “top health insurance providers USA,” “best health insurance 2025,” and “health insurance comparison,” this content is designed to attract a global audience and maximize ad revenue through platforms like Google Ads.

Why Choosing the Right Health Insurance Provider Matters

Health insurance in the USA is a cornerstone of financial and medical security, especially as medical expenses continue to climb. In 2025, the average cost of a hospital stay can exceed $15,000, and out-of-pocket expenses for chronic conditions like diabetes or heart disease can reach $7,000 annually. A top-tier health insurance provider offers comprehensive coverage, a wide hospital network, and efficient claim processing, ensuring you’re protected from financial strain. For a global audience, understanding the U.S. healthcare system and its leading providers is crucial, whether you’re an expat, a traveler, or planning to relocate. This guide leverages high-CPC terms like “affordable medical insurance” and “health plan reviews” to drive high-intent traffic and attract advertisers in the lucrative insurance sector.

Key Factors to Consider When Choosing a Health Insurance Provider

Selecting the best health insurance provider involves evaluating several critical factors to ensure the plan meets your needs. Here’s what to prioritize:

- Comprehensive Coverage: Look for plans covering hospitalization, outpatient care, prescription drugs, preventive services, and specialized treatments like mental health or maternity care.

- Affordable Premiums: Premiums should fit your budget, with individual plans starting at $100/month and family plans at $400/month on average.

- Wide Hospital Network: A network of 10,000+ hospitals ensures access to trusted providers, reducing out-of-network costs.

- High Claim Settlement Ratio: A ratio above 95% indicates reliability in processing claims efficiently.

- Customer Satisfaction: Providers with high ratings from sources like J.D. Power or the National Committee for Quality Assurance (NCQA) offer better service.

- Flexible Add-Ons: Options like dental, vision, or critical illness riders enhance plan value.

- Digital Tools: Mobile apps and telehealth services improve accessibility and convenience.

By focusing on these factors and high-ECPM keywords like “insurance providers ranking,” this content is optimized to attract advertisers targeting health-conscious consumers.

Top 10 Health Insurance Providers in the USA for 2025

Based on coverage options, premiums, customer satisfaction, and market share, here are the top 10 health insurance providers in the USA for 2025. Each provider is evaluated for its strengths, making this guide a valuable resource for a global audience seeking the best health insurance plans.

1. UnitedHealthcare

UnitedHealthcare, part of UnitedHealth Group, is the largest health insurer in the USA, serving over 50 million members. It offers a wide range of plans, including individual, family, and Medicare Advantage options, with a network of over 1.3 million providers and 6,700 hospitals.

Key Benefits:

- Extensive network of 1.3 million+ providers.

- Comprehensive coverage for hospitalization, prescription drugs, and preventive care.

- High customer satisfaction (J.D. Power rating: 4/5).

- Telehealth and wellness programs included.

Premium Range: $120 – $600/month.

Ideal For: Families and seniors seeking robust coverage and a vast provider network.

2. Blue Cross Blue Shield (BCBS)

Blue Cross Blue Shield operates through 35 independent companies, covering over 107 million Americans. Known for its BlueCard program, BCBS offers nationwide access and international coverage in 190+ countries.

Key Benefits:

- Access to 95% of U.S. hospitals and 90% of doctors.

- Comprehensive plans with dental and vision add-ons.

- High NCQA rating (4.5/5).

- Global coverage for travelers and expats.

Premium Range: $100 – $550/month.

Ideal For: Individuals and families needing flexible, nationwide coverage.

3. Aetna (CVS Health)

Aetna, a CVS Health company, serves over 39 million members with affordable plans and innovative digital tools. Its integration with CVS pharmacies offers unique benefits like discounted prescriptions.

Key Benefits:

- Network of 1.2 million healthcare providers.

- Integrated pharmacy benefits through CVS.

- Telehealth and wellness programs.

- High claim settlement ratio (96%).

Premium Range: $110 – $500/month.

Ideal For: Budget-conscious individuals seeking integrated pharmacy benefits.

4. Cigna

Cigna provides global health insurance solutions, serving 180 million customers worldwide. Its plans are known for mental health coverage and wellness programs, making it ideal for holistic care.

Key Benefits:

- Global network of 1 million+ providers.

- Strong mental health and telehealth services.

- Wellness benefits like fitness discounts.

- J.D. Power rating: 4/5.

Premium Range: $130 – $600/month.

Ideal For: Expats and seniors prioritizing mental health and global coverage.

5. Kaiser Permanente

Kaiser Permanente combines insurance with its own healthcare facilities, serving 12.5 million members in eight U.S. states. Its integrated model ensures seamless care and high customer satisfaction.

Key Benefits:

- Integrated care with Kaiser hospitals and clinics.

- High NCQA rating (4.8/5).

- Comprehensive preventive care and telehealth.

- Affordable premiums for integrated care.

Premium Range: $100 – $450/month.

Ideal For: Residents in Kaiser-covered states seeking integrated healthcare.

6. Humana

Humana specializes in Medicare Advantage and supplemental plans, serving over 20 million members. It’s known for its senior-focused plans and robust prescription drug coverage.

Key Benefits:

- Strong Medicare Advantage and Part D plans.

- Network of 700,000+ providers.

- Wellness programs like SilverSneakers.

- High customer satisfaction (J.D. Power: 4/5).

Premium Range: $0 – $150/month (Medicare Advantage).

Ideal For: Seniors seeking Medicare-focused plans.

7. Anthem (Elevance Health)

Anthem, part of Elevance Health, serves 47 million members with a focus on affordable individual and family plans. Its Blue Cross Blue Shield affiliation ensures a vast provider network.

Key Benefits:

- Access to BCBS network (1.7 million providers).

- Competitive premiums for families.

- Telehealth and mental health coverage.

- High claim settlement ratio (95%).

Premium Range: $120 – $550/month.

Ideal For: Families needing affordable, comprehensive plans.

8. Molina Healthcare

Molina Healthcare focuses on Medicaid and Affordable Care Act (ACA) marketplace plans, serving low-income individuals and families. It’s a cost-effective option with strong community focus.

Key Benefits:

- Affordable ACA and Medicaid plans.

- Network of 500,000+ providers.

- Preventive care and chronic disease management.

- High NCQA rating (4/5).

Premium Range: $50 – $400/month.

Ideal For: Low-income families and individuals eligible for subsidies.

9. Oscar Health

Oscar Health is a tech-driven insurer offering ACA marketplace plans with user-friendly digital tools. It serves over 1 million members with a focus on transparency and telehealth.

Key Benefits:

- Free telehealth visits 24/7.

- User-friendly mobile app for claims and care.

- Network of 400,000+ providers.

- Competitive premiums for young adults.

Premium Range: $100 – $450/month.

Ideal For: Tech-savvy individuals seeking ACA plans.

10. Centene (Ambetter)

Centene’s Ambetter plans focus on ACA marketplace coverage, serving over 25 million members. It’s known for affordable premiums and comprehensive benefits for families.

Key Benefits:

- Low-cost ACA plans with subsidies.

- Network of 600,000+ providers.

- Preventive care and wellness programs.

- High claim settlement ratio (95%).

Premium Range: $80 – $400/month.

Ideal For: Budget-conscious families seeking ACA coverage.

Comparing Top Health Insurance Providers

Here’s a comparison of the top providers based on key metrics:

| Provider | Network Size | Premium Range | Unique Feature |

|---|---|---|---|

| UnitedHealthcare | 1.3M+ providers | $120 – $600/month | Extensive telehealth |

| Blue Cross Blue Shield | 1.7M+ providers | $100 – $550/month | Global coverage |

| Aetna | 1.2M+ providers | $110 – $500/month | CVS pharmacy benefits |

| Cigna | 1M+ providers | $130 – $600/month | Mental health focus |

| Kaiser Permanente | Integrated network | $100 – $450/month | Integrated care model |

| Humana | 700,000+ providers | $0 – $150/month | Medicare expertise |

| Anthem | 1.7M+ providers | $120 – $550/month | BCBS affiliation |

| Molina Healthcare | 500,000+ providers | $50 – $400/month | ACA and Medicaid focus |

| Oscar Health | 400,000+ providers | $100 – $450/month | Tech-driven tools |

| Centene (Ambetter) | 600,000+ providers | $80 – $400/month | Affordable ACA plans |

Tips for Choosing the Right Health Insurance Provider

Selecting the best provider requires careful evaluation. Here’s how to make an informed choice:

- Assess Your Needs: Consider your health conditions, family size, and budget to choose a suitable plan.

- Check Provider Networks: Ensure preferred doctors and hospitals are in-network to minimize costs.

- Compare Premiums and Benefits: Balance monthly costs with coverage for hospitalization, drugs, and add-ons.

- Review Customer Feedback: Check J.D. Power and NCQA ratings for insights into service quality.

- Explore Digital Tools: Opt for providers with user-friendly apps and telehealth options for convenience.

Conclusion: Find the Best Health Insurance Provider for 2025

In 2025, the top health insurance providers in the USA—UnitedHealthcare, Blue Cross Blue Shield, Aetna, and others—offer diverse plans to meet individual, family, and senior needs. By incorporating high-ECPM keywords like “top health insurance providers USA” and “best health insurance 2025,” this blog is optimized to attract advertisers and drive high-intent traffic. Compare providers, assess your needs, and choose a plan that ensures comprehensive coverage and financial security. Start exploring options today and secure your health with confidence!

Comments (3)